I-9 Compliance: Common Mistakes and How to Avoid Them

San Jose Employment Immigration Lawyer

As any small business owner or human resources officer knows that employers are legally bound to only hire individuals who are legally authorized to work in the United States. A complicated legal framework has evolved to ensure that employers follow this requirement and at its core is the Form I-9.

This form helps employers determine that the individuals they hire are legally authorized to work in the United States. It is familiar to anyone who has ever worked in the United States, or at least those who have worked in the United States after 1986. New employees must complete this form within three days of beginning employment, although this requirement is slightly different when a person is hired for fewer than three business days.

Mistakes to Avoid

I-9 compliance is critically important to businesses, but the process is far from intuitive. Read on for some frequent pitfalls found in audits and discover the ways they can be corrected or avoided altogether. Remember that these are only a sampling of mistakes that can occur and that it is best to consult with an attorney to ensure proper I-9 compliance.

Original Signature of Employee Missing

It may not seem obvious, but unless an employer has implemented an electronic form I-9 with an electronic signature function, original handwritten signatures must be provided and retained.

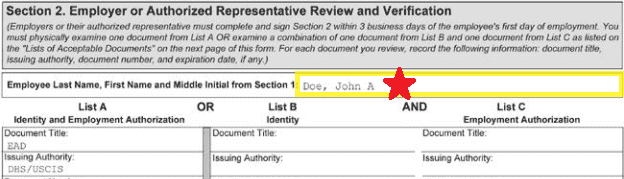

Employee Name Missing from Top of Page 2

This is one of the most frequent omissions we see. It is easy to overlook, but it is important to remember that the employee’s name from Section 1 must be copied over to the top of Section 2, as indicated by the red star below.

Company Certification Missing Authorized Representative’s Title

In order to be correct, the company representative completing the I-9 on behalf of the company must include both their first and last name, company address, and give their full job title -- simply writing “HR” is in the job title space is not enough.

Reverification Missing

Oftentimes employers forget to perform Section 3 reverification. Reverification of employment eligibility must occur for every employee who checks the box in Section 1 indicating that they are “an alien authorized to work until” a specific date. For those employees, reverification must occur on or before the given expiration date given in Section 1.

Reverification Late

Even when employment eligibility is reverified, it is often reverified late. Reverification of employment eligibility must occur for every employee who checks the box in Section 1 indicating that they are “an alien authorized to work until” a specific date. For those employees, reverification must occur on or before the given expiration date given in Section 1. Employees should generally be given notice that their employment authorization is about to expire 90 days before actual expiration, so that any steps which must be taken to obtain an extension of employment authorization may be taken in a timely fashion.

- Reverifying on the original I-9 form. When reverifying on the form used during the initial I-9 verification, only Section 3 must be completed.

- Reverifying on a new I-9 form. If reverification has already occurred in Section 3 of the original form, or if the old version of the I-9 form (pre-May 2013) was used as the original form, a new I-9 form must be completed for the current reverification. However, only the second page needs to be completed and retained. In this case, fill out the employee’s name at the top of Section 2, and then complete Section 3.

Making Corrections to Your Form I-9

If you do make a mistake, how should you fix it? As a rule, white-out should not be used. If you have used white-out, USCIS recommends attaching a signed and dated note to the I-9 explaining what happened. In general, employers may only correct errors made in Section 2 or Section 3 of the I-9; you must ask your employee to correct any errors found in Section 1.

The best way to correct the form is to:

- Draw a line through the incorrect information,

- Enter the correct information; and

- Initial and date the correction.

The above points are only a sampling of the many errors that are often made, even by businesses with the best of intentions. We recommend an annual I-9 audit to ensure full compliance, and avoid any unpleasant surprises down the line.

Retain a knowledgeable immigration attorney to help guide you through employer compliance issues and help prevent detrimental mistakes. Call (408) 560-4622 to schedule your consultation with our firm.

Trusted & Highly Recommended

See What Our Clients Have to Say

-

You and your team have been very patient in answering all my queries and guiding me in the right direction.

Firstly, Thank you very much for your help in getting my L-1A I-140 approved. You and your team (Adriana & Attiya) have been ...

Ramu -

We had an amazing experience and smooth process

We had an amazing experience and smooth process. we have applied for H1b and then EB1C too. They have a very detailed ...

Darshan -

Highly recommend.

We had a great experience working with the Verma Law team for our AOS application. They guided at every step from form ...

H. Modi